Are you facing delays or extra costs when importing heat sinks abroad? The right documents can solve many of those headaches.

Yes — importing heat sinks requires specific customs documentation and compliance files, including correct HS codes, invoices, certificates and possibly extra market‑specific approvals.

Let’s walk through exactly what you must prepare, how to set up your compliance files, which markets demand more, and why HS codes matter in clearance.

What documents apply to heat sink imports?

Imagine your container of heat sinks sits at the border because a key document is missing — frustrating and costly.

You’ll typically need a commercial invoice, packing list, bill of lading/air waybill, customs declaration, proof of origin, plus any safety/compliance certificates for your heat sinks.

When I import aluminium heat sinks (or similar components) I make sure a set of core documents is ready before shipment leaves the factory. Here is a breakdown:

Core documents list

| Document | Purpose |

|---|---|

| Commercial invoice | Shows value, description, terms (Incoterms) — used by customs to determine duties and VAT. |

| Packing list | Details weights, pack dimensions, counts — helps customs and freight handlers identify what’s in each package. |

| Bill of Lading / Air Waybill | Proof of transport contract and shipment receipt — needed to release goods from carrier. |

| Customs import declaration (e.g., C88/SAD in UK) | Provides tariff classification, origin, value and duty/VAT payable. |

| Proof of origin / Certificate of Origin | Confirms where goods were made — important for trade agreements or preferential duty rates. |

| Safety compliance / conformity documents | Especially for electronic parts: declaration of conformity, technical file, marking. |

Why these matter

- Without a correct invoice or packing list, customs might hold or reject the shipment.

- Wrong origin can mean you pay higher duties or miss preferential rates.

- For components like heat sinks used in electronics, you may need to show the item complies with electrical or product safety standards before you can import or later sell.

- After Brexit for the UK: you must include commodity (HS) code on the declaration; it influences duty and VAT.

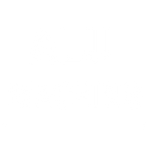

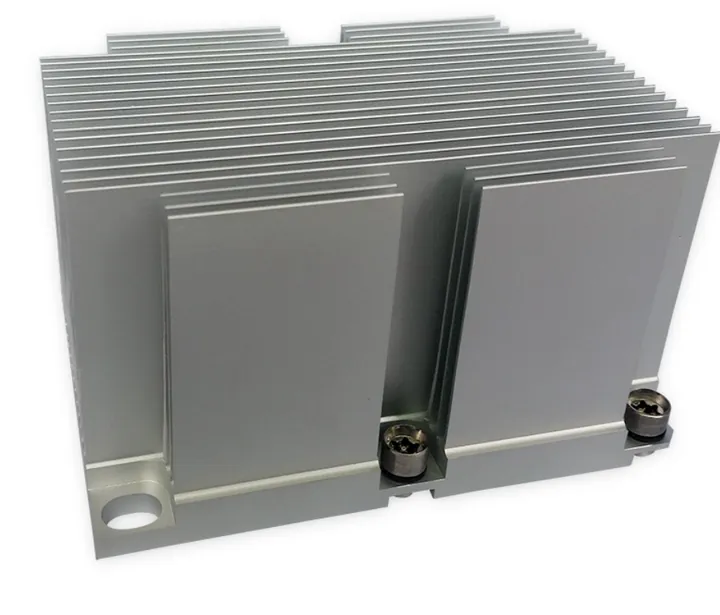

Specific to heat sinks

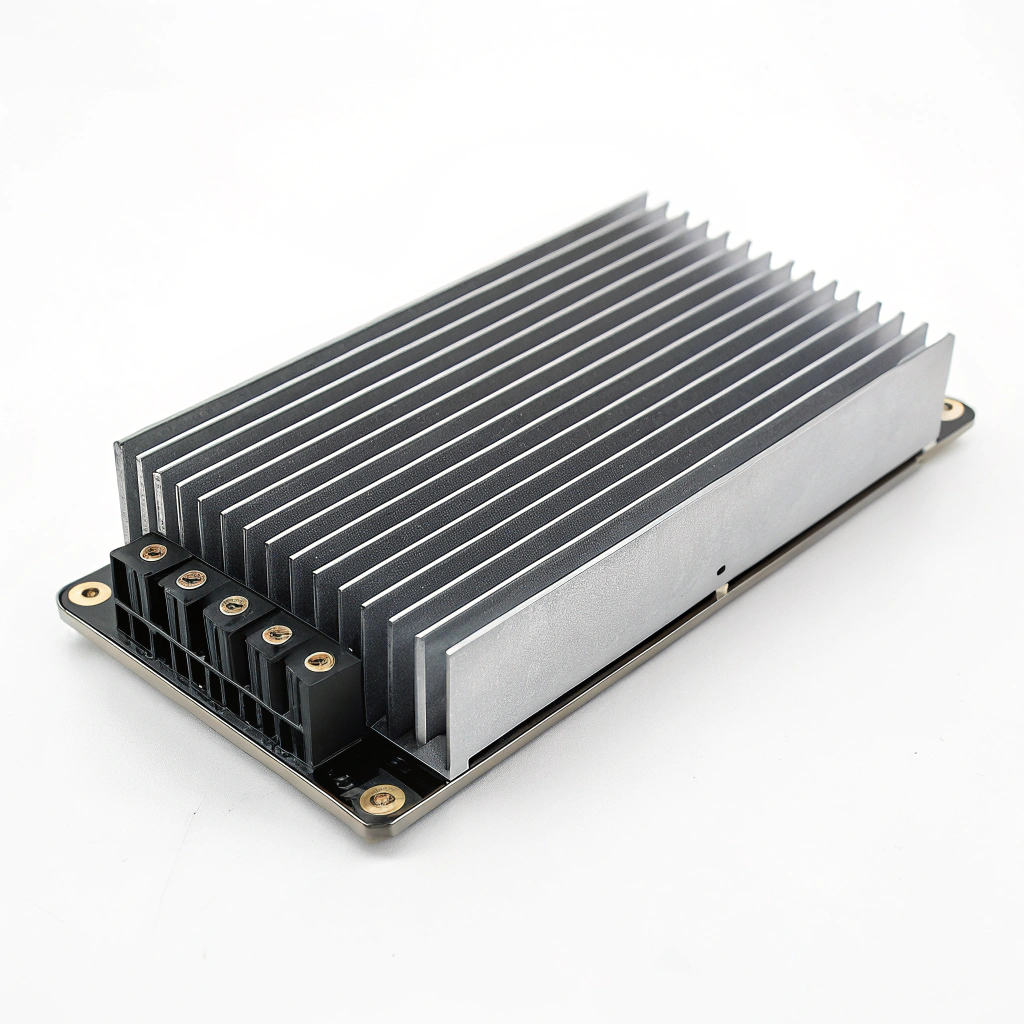

Because heat sinks are often components (for electronics, lighting, industrial machinery) you must identify:

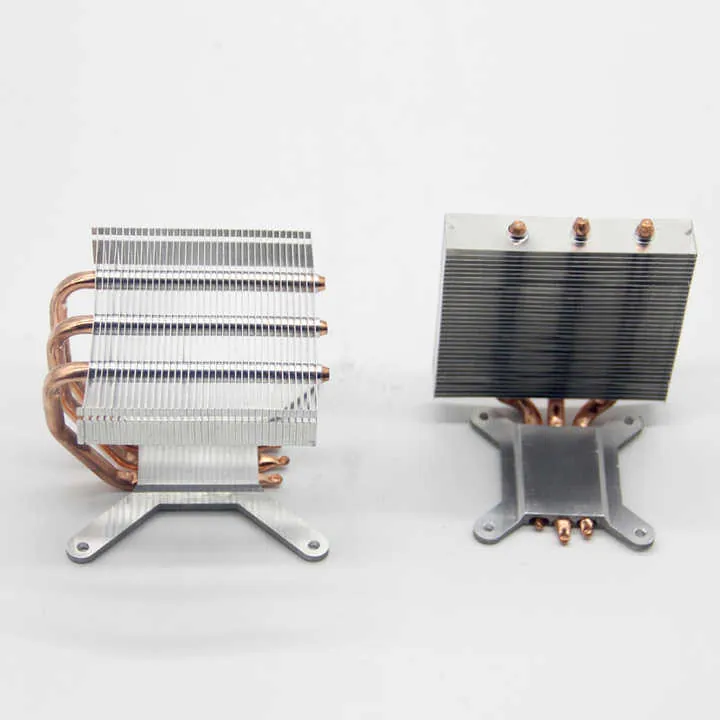

- Whether the item is just an aluminium profile (less regulated) or an integrated electronic module (higher regulation).

- If it falls under electronics or machinery parts, you may need to show that it complies with electrical safety or EMC standards (depending on destination).

- Ensure your description on the invoice clearly states “heat sink aluminium profile” or “LED module with heat sink assembly” etc, so classification and duty rates are correct.

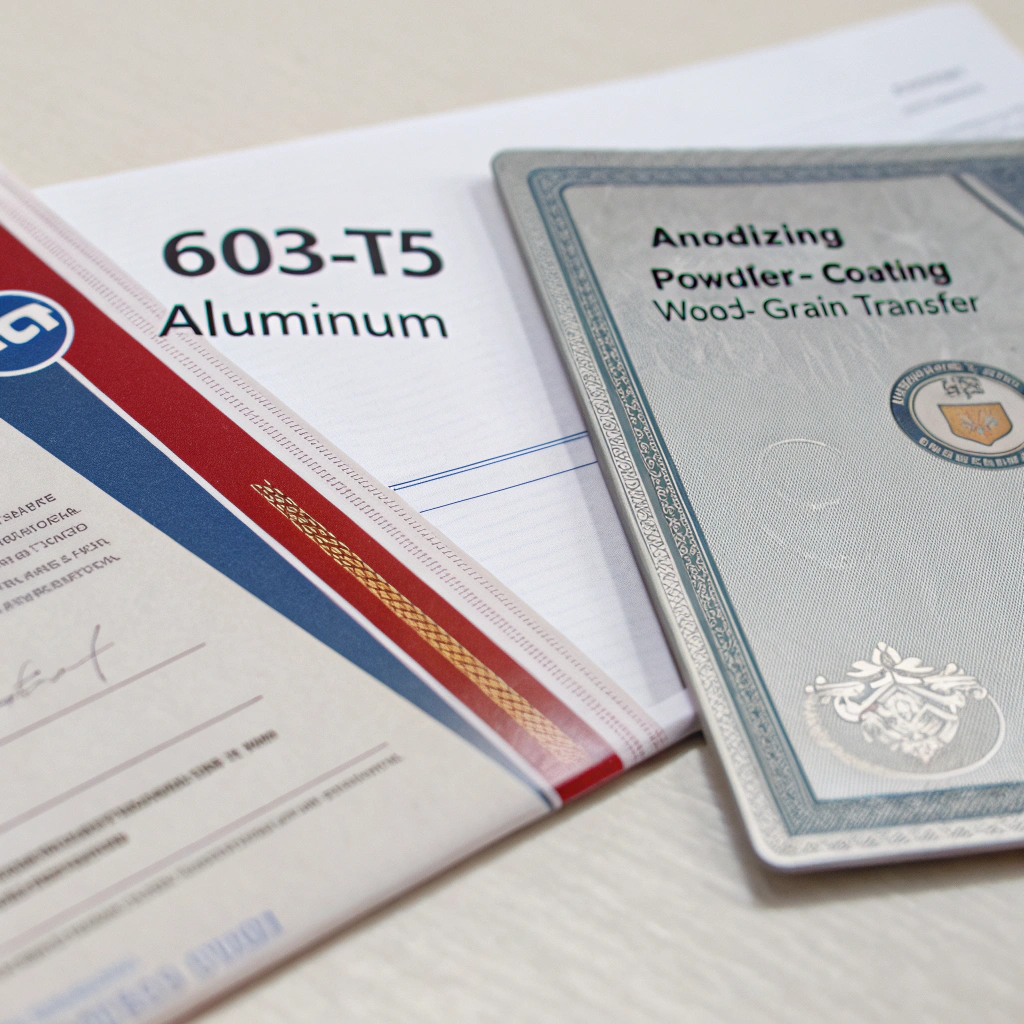

When I prepare for such an import, I also gather the supplier’s material certificate (e.g., aluminium grade 6063‑T5), surface treatment info (anodised, powder coated), since customs might ask for clarity if the item is metal parts or finished electronic assemblies.

In short: the more you clarify upfront, the less likely you face delays.

How do importers prepare compliance files?

Picture starting an import and realising you can’t prove the product meets destination‑market standards — that’s a major risk.

Importers build compliance files by collecting technical specifications, test reports, conformity declarations, supplier certificates and keeping them organized for audit or customs checks.

In my work importing aluminium profiles and heat sinks from China to global markets, I set up a “compliance folder” for each part or product line. Here’s how I do it and you could too:

Step‑by‑step preparation

- Gather supplier documentation

- Material certificate (e.g., 6063‑T5 or 6061‑T6 aluminium)

- Surface treatment certificate (anodising, powder‑coating, wood‑grain transfer)

- Manufacturing drawings and specifications

- Test reports (if required: e.g., dimensional, mechanical, thermal).

- Check regulatory standards

- Identify the destination market (e.g., EU, UK, US, Middle East).

- For electronics/industrial parts: check if your heat sink is part of a regulated product requiring CE / UKCA marking, or safety/EMC tests.

- Check if product marking, labeling, packaging requirements apply.

- Create a technical file or compliance dossier

- Include a cover page with product description, supplier, part number.

- Include all the certificates above.

- Include test reports and conformity declarations (if applicable).

- Keep evidence of origin and materials.

- Maintain versions (date, revision).

- Ensure customs documentation aligns

- Invoice, packing list, bill of lading, customs declaration must reference the same product description and specification.

- Ensure HS code you’ve allocated matches the technical product classification.

- Maintain records of duties paid or preferential origin claimed (if applicable).

- Maintain file and update

- Keep the file for the retention period required in your market (often 5 years or more).

- If product changes (material, dimensions, coating), update the file and notify customers where applicable.

- Audit readiness and traceability

- Be ready to show to customs, market surveillance, or your customer the chain of compliance.

- For B2B supply chain, ensure your own customers can get the documentation they need.

When I skip this preparation, issues can happen: customs may raise an inquiry about product description, delay release until test reports are provided, or even reject preferential origin claims because origin evidence is missing.

By having a robust compliance file I reduce risk of:

- Delayed customs clearance

- Unexpected duty or tax increases

- Market surveillance penalties or product recall.

Since you are in the B2B manufacturing and global export business, offering your customers the full compliance dossier upfront strengthens your position, adds value and reduces importers’ headaches.

Which markets require extra certificates?

Not all markets treat heat sinks the same — some require extra certifications beyond basic customs paperwork.

Markets such as the EU, UK, US, Middle East and Japan often require additional certifications such as CE/UKCA marking, RoHS, REACH, electrical safety or EMC compliance depending on how the heat sink is used.

Since your business exports globally to Africa, North America, Japan, Middle East, Europe, it's important to understand the varying certification demands. Let me share how I approach it.

Key market examples & extra certificate requirements

| Market | Potential extra requirements for heat sinks / components |

|---|---|

| European Union (EU) | CE marking, RoHS, REACH, EMC safety if electrical. |

| United Kingdom (GB) | UKCA marking post‑2024, RoHS, product labelling. |

| United States | UL or FCC if part of electrical device. |

| Middle East / GCC | G‑Mark or local conformity assessments. |

| Japan | PSE marking for certain electrical goods. |

Strategies to manage the extra requirements

- Clarify usage of the heat sink.

- Segment your product lines by regulatory status.

- Maintain market-specific master data.

- Provide summary compliance sheets to clients.

- Use local agents for regulated countries.

- Monitor regulatory changes.

- Store full documentation — even for “non-regulated” parts.

By preparing ahead and understanding each market’s specific extra certificate demands, you reduce risk of goods being held at border and strengthen your reputation as a reliable supplier.

Are HS codes critical for clearance?

Choosing the wrong HS (Harmonised System) code for your heat sink can trigger duty mis‑application, delays or even regulatory non‑compliance — and you don’t want that.

Yes — HS codes (commodity codes) are essential in customs clearance because they determine duty rate, VAT, licensing or certificate requirement, and are used in import declarations.

In my role exporting aluminium heat sinks internationally I make sure we allocate the correct HS code before shipment, because it has big downstream effects.

What is an HS code and why it matters

- Globally recognized classification for customs.

- Determines duty rate and VAT.

- Triggers licensing or certificate needs.

- Prevents over/under-paying duty.

- Minimizes customs disputes.

Specifics for heat sinks

Depending on form and usage, your heat sink might fall under:

- 7604: Aluminium bars, rods, profiles

- 7616: Other articles of aluminium

- 8546: Electrical insulators

- 8419: Machinery parts with thermal role

Use official tariff tools (e.g., UK Trade Tariff) and validate with customs brokers.

How I handle HS codes

- Get detailed product info from supplier

- Use destination country tools to classify

- Document the rationale for chosen HS

- Include consistent code in invoice and declaration

- Watch out for dual-use or electronics rules

Correct HS code selection reduces risk, speeds up clearance, ensures the right taxes, and helps your clients feel secure.

Conclusion

In short: importing heat sinks globally demands more than shipping logistics — you must master the correct documents, build thorough compliance files, understand the extra certificates for each market, and use the right HS/commodity codes for clearance. Get all four right and you’ll protect your supply chain, strengthen your reliability, and support your global B2B customers without headaches.